International Students Loan Navigating the financial landscape as an international student can be challenging, especially when it comes to securing funding for your education. International student loans are a vital resource for many students pursuing their studies in the United States. This guide outlines the step-by-step process for applying for international student loans, ensuring you have the necessary information to finance your academic journey.

Step 1: International Students Loan Understand Your Financial Needs

Before applying for a loan, assess your financial needs. Calculate the total cost of your education, including tuition, fees, living expenses, books, and supplies. Having a clear understanding of your financial requirements will help you determine how much you need to borrow.

Step 2: Research Loan Options

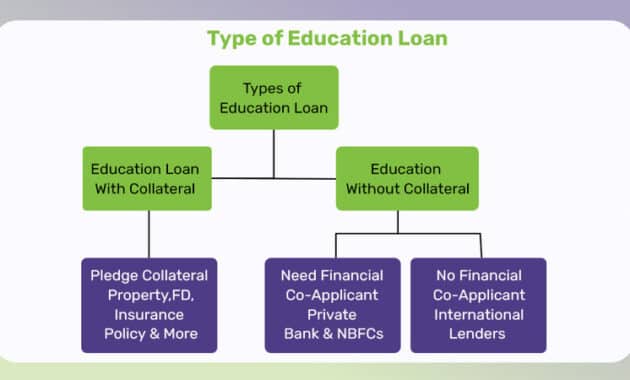

There are various types of loans available for international students, including:

- Private Loans: Many banks and financial institutions offer loans specifically for international students. Research lenders that specialize in education financing for non-U.S. citizens.

- University Loans: Some universities provide their own loan programs for international students. Check with your university’s financial aid office to see if this option is available.

- No-Cosigner Loans: Certain lenders, like Prodigy Finance and MPOWER Financing, offer loans without requiring a U.S. co-signer, which can be beneficial if you don’t have access to one.

Step 3: Gather Required Documents

Once you’ve identified potential lenders, gather the necessary documentation for your loan application. Common documents include:

- Proof of Admission: Your acceptance letter from the university and the I-20 form.

- Transcripts: Academic records from previous institutions.

- Financial Statements: Bank statements or proof of income to demonstrate your financial need.

- Passport Copy: A valid passport that confirms your identity.

- Co-signer Documentation (if applicable): If you are required to have a co-signer, gather their financial information and proof of citizenship or residency.

Step 4: Complete the Loan Application

Fill out the loan application form accurately and thoroughly. Most lenders offer online applications that are straightforward to complete. Be sure to provide all required information and double-check for any errors before submission.

Step 5: Await Approval

After submitting your application, it will be reviewed by the lender. The approval process can take anywhere from a few days to several weeks, depending on the lender’s policies and your individual circumstances. During this time, maintain communication with the lender to track your application status.

Step 6: Review Loan Offers

If approved, you will receive a loan offer detailing the amount you can borrow, interest rates, repayment terms, and any associated fees. Carefully review these terms to ensure they align with your financial situation and repayment capabilities. Don’t hesitate to ask questions or negotiate terms if necessary.

Step 7: Accept the Loan and Complete Final Steps

Once you are satisfied with the loan offer, accept it according to the lender’s instructions. You may need to sign a loan agreement outlining all terms and conditions. After acceptance, the funds will typically be disbursed directly to your university to cover tuition and other expenses.

Also Read : 10 Best Universities In The World For Scholarships

Conclusion

Applying for international student loans is a crucial step in financing your education abroad. By understanding your financial needs, researching loan options, gathering necessary documentation, completing applications accurately, awaiting approval patiently, reviewing offers carefully, and accepting loans responsibly, you can navigate this process effectively. With proper planning and diligence, you can secure the funding needed to achieve your academic goals.

FAQs

1. What types of loans are available for international students?

International students can access private loans from banks or financial institutions, university-specific loans, and no-cosigner loans from specialized lenders.

2. Do I need a co-signer to apply for an international student loan?

Many lenders require a U.S. co-signer; however, some options exist that do not require one.

3. How long does it take to get approved for an international student loan?

Approval times vary by lender but typically range from a few days to several weeks after submission.

4. What documents do I need when applying for a loan?

Commonly required documents include proof of admission (I-20 form), transcripts, financial statements, passport copies, and co-signer documentation if applicable.

5. How much can I borrow with an international student loan?

The amount varies based on the lender and your financial needs; it’s essential to calculate all educational costs beforehand.

6. What should I do if my loan application is denied?

If denied, review the reasons provided by the lender; consider applying with another lender or exploring alternative funding options such as scholarships or grants.